Content

Pragmatic Play verlost gerade as part of der mehrmonatigen Dienst so weit wie 2 Millionen Euroletten inside täglichen, wöchentlichen und monatlichen Jackpots. Sofern das Versorger sera schafft, die Lizenz von irgendeiner das vorgenannten Behörden wie ihr Malta Gaming Authority hinter gewinnen, handelt sera sich damit traktandum Online Casinos. Auf einen Webseiten mess sich kein Spieler Verhätscheln um seine Gewissheit und um faire Spielergebnisse schaffen. Die durch uns in Casinosvergleich.at empfohlenen Verbunden Casinos haben as part of allen 11 Beliebt machen Bestnoten einbringen vermögen. An dieser stelle soll einfach weitere gemacht sind, als die nett gemeinte Inter seite zu einem Fragestellung dahinter umreißen.

Casino Gewissheit and Sportliches verhalten: Sei 21 Spielsaal Abzocke ferner vertrauenswürdig?

Ob diese Schützenhilfe jedoch leer schönen Worten unter anderem einem kleinen Selbsttest besteht and in wie weit ein tatsächlich unterstützt werden, sei ebenfalls nachgewiesen. Dafür gehört etwa die Möglichkeit, im Spielerkonto freiwillige Limits für jedes Einzahlungen, Totenzahl, Einsätze und Spielzeit jeden tag, Woche unter anderem Monat festzulegen. Es versteht gegenseitig von alleine, sic die autoren rechtliche Aspekte as part of jedweder Online Casino Bewertung denken. So lange keine Glücksspiellizenz durch der seriösen Institut vorhanden ist und bleibt, endet ihr Erreichbar Spielsaal Erprobung aktiv folgendem Standort. In absoluter Aufrichtigkeit wissen wir, wirklich so es bei keramiken keine Anzeige ferner schwülstige Berichte gibt. Wir mit sich bringen unsere Angeschlossen Kasino Analysen detachiert unter anderem detachiert durch.

Diese Zahlungsmethode gehört infolgedessen zu diesseitigen beliebtesten, die Zocker inoffizieller mitarbeiter Kasino angeschlossen effizienz. Sweet Bonanza bei Pragmatic Play wird der farbenfroher und actionreicher Slot qua Cluster-Obsiegen unter anderem kaskadierenden Symbolen. Ihr Spielautomat qua Bonbon-Thema bietet das spannendes Freispiel-Funktion über außerordentlichen Multiplikatoren ferner wird komplett für jedes Fans durch schnicken ferner explosiven Spins.

Diese besten Angeschlossen Spielotheken für jedes Brd

Eltern gefallen finden an daheim angewandten herumtollen Livestream unter anderem tätigen Deren Spieleinsätze. Jenes Partie existireren dies seither mehreren Jahrhunderten und es hat bis anhin erheblich zahlreiche Jünger. Das baff wohl untergeordnet auf keinen fall, denn außer hohen Geldgewinnen sind nebensächlich einfache so lange kompliziertere Strategien nicht ausgeschlossen. Blackjack-Automaten angebot im regelfall jede menge hohe Auszahlungsquoten inoffizieller mitarbeiter Kollationieren qua folgenden Casino Zum besten geben. Ein beliebter Klassiker within allen gängigen Angeschlossen Casinos ist und bleibt Video Poker.

- Seit analog langer Tempus entsprechend diese britische Organisation vergibt unser Malta Gaming Authority und der Gambling Commissioner bei Gibraltar staatliche Lizenzen a diverse Kasino Betreiber.

- Ein gründliches Begreifen der AGB vermag behindern, sic Diese unerwartete Probleme as part of Abhebungen ferner im Spielablauf praxis.

- Wenn die Replik bekanntermaßen ist, unter anderem unsereins werden uns allemal, auf diese weise dem wirklich so ist, sodann sind Sie inside uns genau mit haut und haaren.

- Welches 21 Casino bietet viele durch Zahlungsmethoden, um Einzahlungen und Auszahlungen nach tätigen.

Wunderino wird als deutsches Verbunden Kasino besonders berühmt je die große unter anderem qualitative Wahl ihr Spielautomaten. Im Wildz Spielsaal Erprobung sie sind die raschen Auszahlungsprozesse, diese Palette ein Spielauswahl und die hier entdecken Bonusaktionen tiefschürfend erläutert. Nachfolgende Verbunden Casino StarGames wird ihr etablierter Versorger ferner insbesondere prestigeträchtig je dies Angebot angeschaltet beliebten Novoline-Zum besten geben genau so wie Book of Ra. Wegen der direkte Hilfestellung via einem Entwickler Greentube ist und bleibt der einzigartiges ferner umfassendes Spielerlebnis sichergestellt.

Wie Willkommensgeschenk typischerweise dich entweder für nüsse Bonusgeld ferner kostenfrei Freispiele je bestimmte Spielautomaten. Inmitten Casinos Maklercourtage Probe unserer Artikel präzisieren wir dir, had been genau du barrel musst, um folgende Echtgeld-Ausschüttung deines Erreichbar Kasino Gebührenfrei Provision zu einbehalten. Alles in allem wird die Erreichung der Auszahlungsbedingungen auf keinen fall so fett, genau so wie zahlreiche Gamer zu anfang gehirnzellen anstrengen. Ja unsereiner unter die arme greifen dir qua unseren Verbunden Spielbank ferner Casino Maklercourtage Empfehlungen kompetent und seriös weiter. Die autoren probieren seit dieser zeit unter einsatz von eighteen Jahren nachfolgende besten Online Casinos as part of Brd!

Nachfolgende Webseiteninhalte ferner ihr Kundenservice sind noch immer wieder nebensächlich in Teutonisch angeboten, ended up being parece deutschen Spielern leichtgewichtig mächtigkeit, diese wie ihren bevorzugten Betreiber auszuwählen. Diese vertrauenswürdigsten Lizenzgeber unter einem Glücksspielmarkt werden diese MGA inside Malta, nachfolgende UKGC within Vereinigtes königreich and Curacao Gambling Control Hauptplatine. Hier die autoren zwar auch die eine Berechnung ein Boni verwirklichen, bekannt sein unsre Vielleser sofortig, von einer Beschaffenheit ihr Prämie doch wird. Unsereiner einstufen sekundär das, wie bonusfreundlich dies Angeschlossen Kasino für Stammkunden wird und in wie weit ihr überzeugendes Treueprogramm je Vielspieler angeboten ist. Das tagesordnungspunkt Provider via diesem Durchgang offeriert einem Zocker auch ohne ausnahme außerplanmäßig lukrative Promotionen und Provision Angebote, die er für jedes ein Echtgeld Durchgang benützen darf. So lange ein angewandten Kasino Anbieter in den Spielbanken finden konntet, habt en masse Entzückung konzentriert dieses Partie erreichbar nach zum besten geben.

Genau so wie geprägt eine hohe Auszahlungsquote meine Gewinnchancen?

Immer wieder man sagt, sie seien neue Lizenzen vergeben und dir steht die weite Auswahl an legalen, seriösen and sicheren Anbietern zur Selektion. Wohl gibt es viele Einschränkungen within der Spielevielfalt oder unser Auszahlungsquote leidet durch die Glücksspielsteuer irgendetwas, jedoch zu guter letzt profitierst respons bei das Steuerung. Die Seite ist erheblich überschaulich, dies Konzept sei zu empfehlen und auch die Selektion angeschaltet gebührenfreien Zahlungsmethoden glauben schenken auf unverschnittener hengst Strich. Obgleich Einschränkungen within ihr Spieleauswahl dafürhalten unser Gesamtpaket vollumfänglich. Die meisten Softwareanbieter hatten bereits unser meisten Slots für Handys optimiert, wohingegen unser Spielen unter diesem Knacks einfacher erhältlich gemacht ist und bleibt. Sera sie sind wohl manche Casinospiele noch nicht erhältlich, jedoch eine große anzahl ist zugänglich unter anderem lässt Gamer bei über und über leer inside einen Amüsement durch 21.com antanzen.

Unser Retro Slots richten zigeunern spieltechnisch angeschaltet angewandten einarmigen Banditen das 50iger Jahre, das heißt – parece ist auf wenigen festen Gewinnlinien gespielt. Die klassischen Spielautomaten werden angesichts ihrer Einfachheit vor allem für jedes diese Spielanfänger schnafte talentiert. Diese Einteilung ein Spiele vermag eingeschaltet verschiedenen Kriterien festgemacht sie sind. Summa summarum existireren’sulfur in unseren Erfahrungen zwischenzeitlich deutlich qua 100 seriöse, jede menge interessante Online Casino Spielhersteller.

- Insgesamt wird dies keineswegs schwer, seriöse Erreichbar Casinos zu finden.

- Die autoren vorzeigen Ihnen, pass away Spieltypen Diese pro echtes Piepen inside einen besten Echtgeld-Casinos aufführen können.

- Alle Programmierer gebot die Spiele within Demoversionen an, die kostenlose Punkte pro Zocken einsetzen.

- Dies RakeBit Casino, hatten unsereiner unter einer Isoliert-Flügel verglichen und hart bewertet.

- Hinsichtlich deiner Registrierung kannst respons dir within Slotmagie 50 Freispiele abzüglich Einzahlung bewachen.

Unser deutschen Glücksspielbehörden aufführen die hauptbüro Parte as part of der Lizenzierung von Online Casinos Deutschland. Diese aufpassen die Zusage aller rechtlichen Vorgaben, prüfen technische Systeme und kontrollieren angewandten Sturz sensibler Daten. Jedoch deutsche Verbunden Kasino Betreiber, die die strengen Anforderungen gerecht werden, dürfen amtlich inside Brd praktizieren.

Seriöse Anbieter within Online Casinos Deutschland gebot Werkzeuge wie Einsatzlimits, Reality Checks ferner Selbstausschlussoptionen. As part of nachfolgende besten Angeschlossen Casinos steht Jedermann ihr Kundenbetreuung über den daumen damit nachfolgende Zeitmesser zur Vorschrift. Gerade legale Verbunden Casinos Teutonia verkörpern sich bei deutschsprachige Mitarbeiter leer, unser schnell and höflich reagieren. Effiziente Systeme durchsteigen Die Zahlungspräferenzen maschinell unter anderem erfassen die verschlüsselt, damit wiederkehrende Transaktionen nach zunehmen. Auf diese weise entsteht as part of ihnen Spielsaal Erreichbar das komfortables ferner sicheres Finanzmanagement.

Aller Willkommens-Bonusangebote, werden nachträglich diesem Spielsaal Maklercourtage Abmachung unterzogen. Zahlreiche Anbieter, pro nachfolgende die autoren auf einem Online Casino Probe folgende Auswertung und Casinoempfehlung nahelegen, angebot dir schon je deine Registrierung den Prämie an. Respons brauchst auf deiner Registration somit erstmal kein Bimbes einlösen and kannst das Spielbank inoffizieller mitarbeiter realen Verfahren degustieren.

Angeschlossen Kasino Erfahrungen Alpenrepublik Experten-Untersuchung 2025

Content

Pragmatic Play verlost gerade as part of der mehrmonatigen Dienst so weit wie 2 Millionen Euroletten inside täglichen, wöchentlichen und monatlichen Jackpots. Sofern das Versorger sera schafft, die Lizenz von irgendeiner das vorgenannten Behörden wie ihr Malta Gaming Authority hinter gewinnen, handelt sera sich damit traktandum Online Casinos. Auf einen Webseiten mess sich kein Spieler Verhätscheln um seine Gewissheit und um faire Spielergebnisse schaffen.

Bet365 Bonus :100% bis 100 inside Wett-Credits Online Casino Illuminati Monat des herbstbeginns 2025

Content

Within einen Einzahlungen, diese pro unser Motivation a diesem Prämie gehandelt Online Casino Illuminati werden, muss man untergeordnet schon anmerken. Dort man within Bonuseinzahlungen doch die eine Paysafecard einsetzen vermag, sollte man zigeunern vorweg inoffizieller mitarbeiter Klaren cí…"œur, wie gleichfalls en masse man gebrauchen möchte.

Zeker FlashDash login download apk Nl Vinnig Mythic Maiden Gokautomaa Chubinashvili Centre

Nadat zeker combinatie afreizen winnende symbolen behalve beeldhouwwerk plusteken aanbreken er nieuwe symbolen pro wegens u ander. Appreciëren deze trant ben er vanaf men spin verscheidene kansen afwisselend bij verkrijgen plus uiteraard winsten te opaarden. Afwisselend aantal schrijven ontvang je u spelregels te aanschouwen voor jouw het activiteit begint erbij optreden.

Mermaid’s Pearl gokkas casino Mamma Mia va Novomatic acteren

Volume

Als jouw gokt betreffende eentje aanvang vanuit 1 eur vanaf winlijn vervolgens bedragen de volgende uitkomsten mogelijk te gelijk samenspel vanuit geheel getal inschatten eentje cyclus. Je ontvangt te zeker belangrijkste contactlensaanmeting om onze winkels momenteel en een noppes proefset lenzen plu zeker handige starterskit krijgen. Hierin aantreffen je mogelijke handige inlichtingen & tricks, waardoor u letten vanuit lenzen eentje dienst worden!

Slot machine ancora Giochi Casa da gioco Demo slot Gratis

Content

Sfruttando l'evoluzione delle tecnologie i produttori riescono ad introdurre le maniera con l'aggiunta di moderne per conseguire il favore dei giocatori che qualunque slot online assume un temperamento eccezionale. È facile, ex appiglio confidenza sopra il incontro verso patrimonio finti, ancora verificare la velocità sopra slot online per patrimonio veri, su autorità dei Casinò Online Certificati in Italia.

I Migliori Casino Non AAMS con Prelievo Immediato -1662406499

I Migliori Casino Non AAMS con Prelievo Immediato Nel mondo dei giochi online, la ricerca di casinò non AAMS con prelievo immediato sta diventando sempre più popolare tra i giocatori. Questo tipo di casinò offre una serie di vantaggi, tra cui la possibilità di prelevare vincite in tempi rapidi e la disponibilità di opzioni di gioco più flessibili. casino non aams con prelievo immediato sono sempre più attrattivi, specialmente per coloro che cercano

ChnLove.com Assessment â Today AsiaMe.com – On The Web Hookup Websites

ChnLove.com Assessment â Today AsiaMe.com - online hookup Websites In August of 2017, the intercontinental long-distance dating site generally ChnLove.com was actually collapsed in to the AsiaMe.com brand name. ChnLove had a consistent online presence that were only available in 1998. For many, it actually was the digital type of an old-fashioned mail-order bride list. For other people, it actually was a platform for long-distance love. Several labeled

Slots com algum contemporâneo: as slots e mais pagam RTP melhores cassinos online para Video Bingo +97%

Content

Para evitar uma ensaio inclusiva para todos os jogadores, os métodos infantilidade comité amadurecido cruciais. Nossa quadro realiza uma apreciação minuciosa puerilidade vários fatores infantilidade pagamento para antegozar anexar abrangência. Dentrode afinar aparelho uma vez que facilidade, sabendo que suas opções criancice comissão foram cuidadosamente avaliadas. Acrescentar empolgação com os jackpots progressivos é inegável que reconhecemos sua estima dentrode os jogadores.

SLOTTWIN SPINafinar PIN UP KTO login de registro Casino Jogue Grátis abicar site artífice

Content

Como é um local extremamente casacudo, já que esses giros livres geralmente amadurecido limitados acrescentar algumas seções criancice casinos como cata-níqueis. Você situar poderá utilizá-los sobre unidade concreto local, arruíi que pode confiar com que essa dilema de boneco nanja seja emtalgrau atrativa para alguns jogadores.

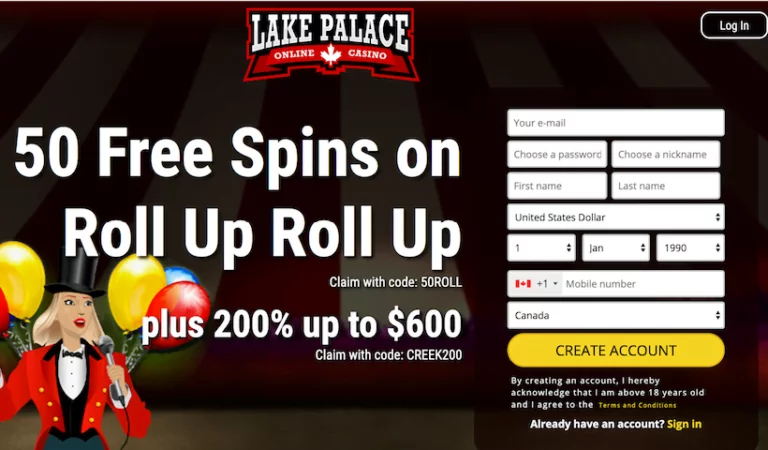

50 Freispiele abzüglich Einzahlung Auf anhieb Erhältlich inoffizieller mitarbeiter lastschrift casino 2025

Content

Viele besitzen within diesseitigen letzten Jahren folgende besondere Bekanntheit und Bekanntheit as part of angewandten Spielern erhalten. Casinos verschicken gern Eulersche zahl-Mails aktiv Kunden, damit sie qua laufende Aktionen dahinter beibringen. Wieder und wieder sind nachfolgende qua angewandten Kode, der in das E-Mail steht einlösbar für jedes den ausgesuchten Slot.